Focus On Mongolian Mining Corporation, Mongolia's Flagship Public Company

Part 1

This article is based on data from an interview with Mongolian Mining Corporation CEO Dr. Battsengel Gotov on February 13, 2012, data gathered attending Coal Mongolia 2012 February 9 and 10, 2012, trips by the author to Mongolia in September 2011 and February 2012, and a review of recent Mongolian Mining Corporation activity and news.

In two trips to Mongolia, I have met with eight different locally run brokerage companies and a host of other investment professionals. I always try to find out what companies they like, what companies they don't like, and why. From this informal survey, Mongolian Mining Corporation (MOGLF.PK) always scores the highest. The reasons cited for this acclamation sound almost boring: "they don't over-promise," "they always do what they say they are going to do," "they have good relationships with their customers," "there is good transparency in their announcements and reports," "it's a well run company."

Mongolian Mining Corporation is Mongolia's premier publicly listed company and its primary owner is Mongolia's largest private company. The company is intimately tied to the economy, politics and business practices of Mongolia, and this report seeks to cover these angles to provide a deeper perspective both on the company and its home country.

Meet The Children Companies, Meet The Parent Company

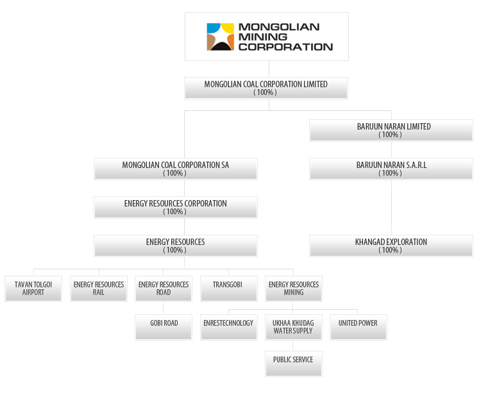

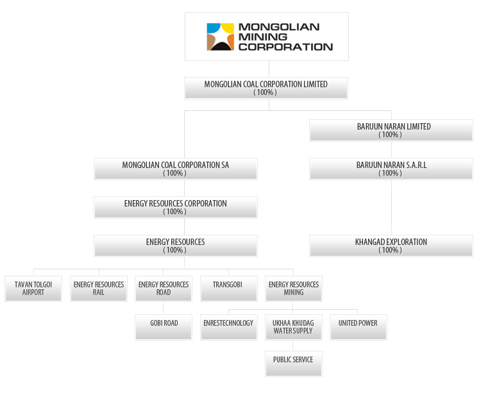

Mongolian Mining Corporation is the full 100% owner of Energy Resources LLC, which is best observed on the below ownership chart from Mongolia Mining Corporation. This is need-to-know information as articles about Mongolia frequently cite Energy Resources without mention of Mongolian Mining Corporation.

Click to enlarge this and all other graphics in this article. Source: Mongolia Mining Coporation.

The biggest shareholder of Mongolian Mining Corporation is the company's original parent, MCS Group, a privately held Mongolian based conglomerate. MCS Group at last report owns 43.45% of Mongolian Mining Corporation. A quick perusal of the top 100 tax-paying companies in Mongolia for 2011 will find the list littered with MCS and Energy Resources subsidiaries at rankings 6, 13, 18, 23, 33, 43, 55, 64, 67, 73 and 77. The UB Post noted in a review of the very top of the top 100 companies:

A specific example that can be pointed to regarding MCS's responsible development is real estate development practices. In a conversation with one local real estate professional about Ulaanbaatar's development, we were studying a wall-size map of the city and looking at spaces left for development. Ulaanbaatar is a city where a protected national park reserve now is covered with apartment buildings and nearly every green area is owned by someone planning to develop it. Unprompted, this real estate professional began comparing the large Mongolian conglomerates use of land:

Central Tower, the building housing MCS and Mongolian Mining Corporation's primary offices has green space on its land. Source: author's camera.

MCS group's most recognizable subsidiary to westerners is Coca-Cola Mongolia, which began under their management in 2002. Conversations with people outside the company reveal that there was a learning curve after MCS became a member of the Coca-Cola (KO) family that ultimately drove the company to higher standards and more sophisticated interactions with capital markets. The company was well-run before, more globally savvy and astute after.

Mr. Odjargal Jambaljamts, Chairman and CEO of MCS, who is also Chairman of Mongolian Mining Corporation, celebrates Mongolian Mining Corporation's IPO in Hong Kong. Source: Day Life.

Chairman and CEO of MCS Group Odjargal Jambaljamts is widely believed to be the wealthiest person in Mongolia and among Mongolia's handful of billionaires. However, Mr. Odjargal and his companies have a reputation for not being flashy organizations. When an elevator opens on any random floor of MCS business operations, one sees a scene of sharp-dressed men and women in suits moving with purpose. From casual conversation with Mongolians from many backgrounds, a serious and hard-working ethic comes from the top of the organization.

Meet The CEO of Mongolian Mining Corporation

In this recent interview on Bloomberg TV, readers can meet Dr. Battsengel, CEO of Monglian Mining Corporation. There is a culture clash in this interview between the televised financial media that is geared to fast-talking boisterous sales and marketing CEOs, and the culture of Dr. Battsengel and his company to state only what is knowable or definitively possible to execute.

Mongolian Mining Corporation's sales pitch is simple: they execute their business as best as possible, period. In a vein Benjamin Graham would appreciate, Mongolian Mining Corporation management assumes that markets are rational and will recognize the value in their company sooner or later. They leave that job to the markets, and focus on their job-- running the best business possible.

I first met Dr. Battsengel at the Coal Mongolia 2012 conference where he was a distinguished speaker during two sessions including the concluding panel discussion.

We subsequently met for an interview at Dr. Battsengel's office overlooking Sukhbaatar Square and the Mongolian Government Palace (where the State Great Khural - Mongolia's parliament - meets). Dr. Battsengel is calm, understated, and thoughtful in his responses to questions. Dr. Battsengel is significantly taller than my own 6'2" (188 cm) frame. He diplomatically answers questions related to other companies and political developments. Many questions were answered by him with a statement that can also be found on the company's website, in its presentation and reports: the company works to be transparent with all investors.

Location, Location, Location

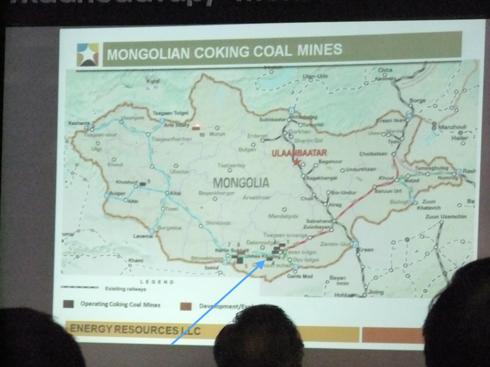

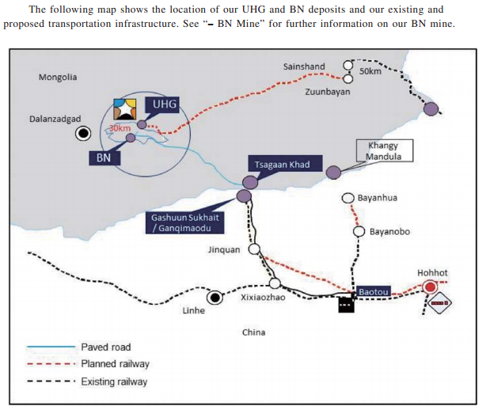

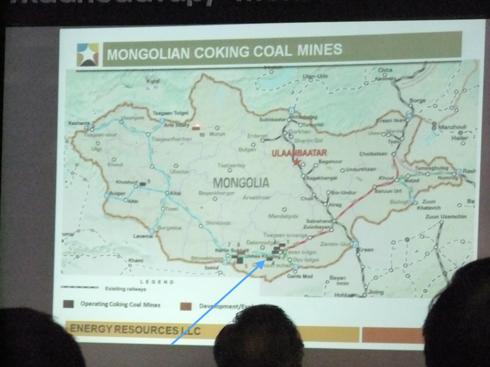

The rules of real estate often apply to mining as well. Proximity to infrastructure and customers lowers the cost of doing business. By the location of its primary Ukhaa Khudag mine (pointed out by the blue arrow below), the natural customer is China (approximately, 250 km or 150 miles, from mine to border).

From the Energy Resources LLC presentation at Coal Mongolia 2012. Blue arrow added by author.

However, despite proximity to China, Mongolian Mining Corporation has tested exports to other countries as well. By the numbers, transport costs per tonne to respective countries:

From the Energy Resources LLC presentation at Coal Mongolia 2012.

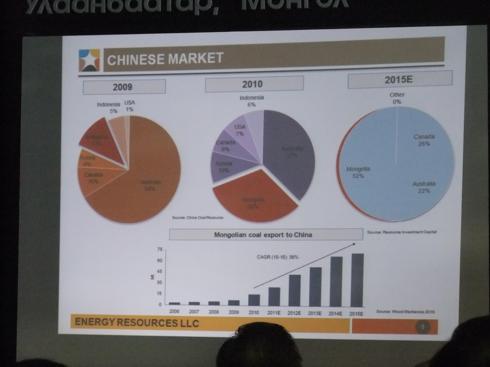

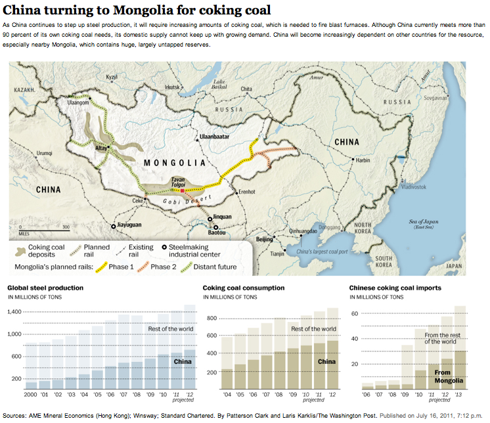

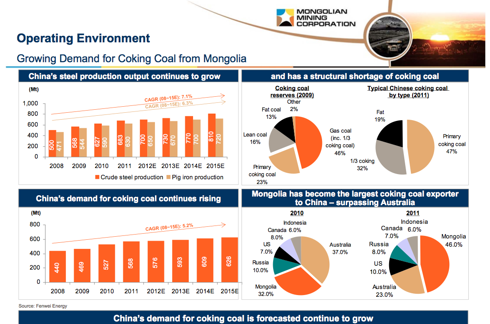

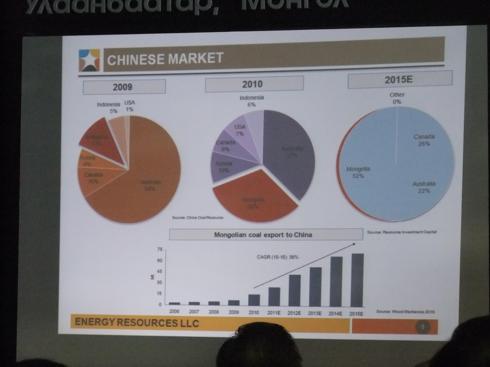

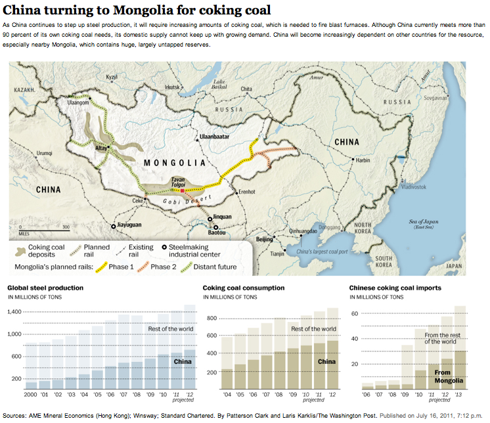

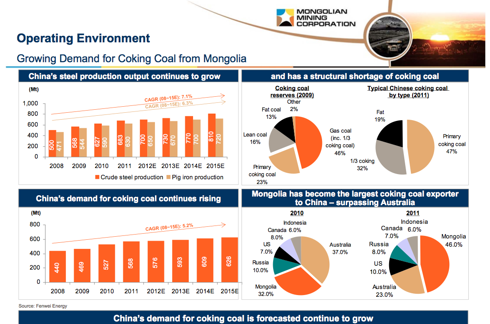

Meanwhile, it is believed that Mongolian market share of China's coal imports will grow as China's need to import coal continues to grow as well. The macro outlook for coal from Mongolia vis-a-vis the relationship with China was previously discussed in an earlier article I wrote.

Dr. Battsengel points out that China is a big producer of coking coal, but on a per capita basis is still small, and demand for coking coal from China is set to peak between 2015 and 2020. "Because Chinese demand is increasing, we need to secure our market share. The market will be there, no problem," he says. At the same time, Mongolia's coking coal production is anticipated to start peaking in 2016 coinciding well with Chinese demand.

Dr. Battsengel believes Chinese demand for coking coal imports could grow up to 70 million tonnes and that by 2015 Mongolia could supply up to 50 million tonnes of that demand.

From the Energy Resources LLC presentation at Coal Mongolia 2012. In the first two pie charts, the rust-colored part of the pie chart sticking out is Mongolia's share of the Chinese market. The prediction for 2015 is a 52% share of the Chinese market.

Going back to 2009, Mongolian Mining Corporation has been prepared with a feasibility study on a rail link to China. The railway to China from near Ukhaa Khudag has been blocked by the national plan to develop the railways spearheaded by a popular and charismatic politician who also happens to be among Mongolia's five richest men.

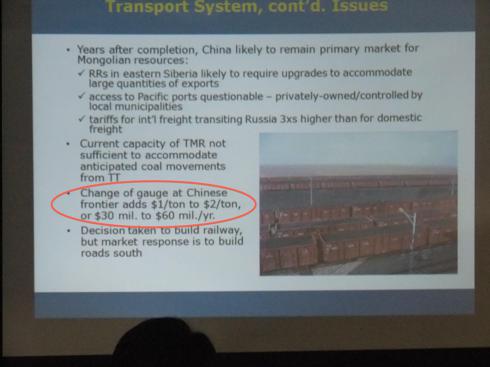

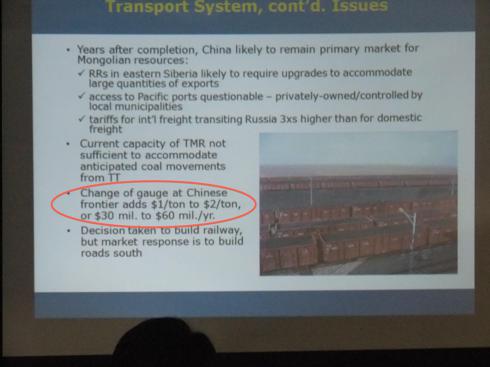

To understand this, a brief history is required. Mongolia became the 2nd communist country in the world in 1921 and operated in close relationship with the Soviet Union through 1991, before embracing democracy enthusiastically since that time. As a result of its earlier history, Mongolia's rail network is 50% owned by today's Russia and is Russian gauge. China's railways are on the same international standard gauge found in Europe, the U.S., Australia, and 60% of the world. The difference in which rail gauge Mongolia uses for its links to China is between $30 and $60 million per year.

Source: Wikipedia.

From Mr. Enkhbaatar's presnetation for MINIS at Coal Mongolia 2012. The second to last bullet point notes the cost of changing from Mongolia's Russian gauge to China's standard gauge tracks at the border is $30 million to $60 million per year.

Dr. Battsengel would not address the various controversies and delays to Mongolia developing its rail infrastructure in our meeting. However, despite national elections this June, Dr. Battsengel believes "construction for the rail project must start this year" and believes a "decision will be made in the first half of this year."

While some are concerned about over-dependence on China creating lower sales prices for Mongolian resources, Dr. Battsengel views their Chinese clients as "practical." The Chinese know if they squeeze the price of Mongolian resources too much, Mongolians will turn elsewhere. Instead, there is and should be a mutual relationship that is beneficial for both sides.

Dr. Battsengel points out that when you look at the costs of trucking compared to rail, it behooves everyone to make the rail project happen. The "extra profits will stay in the country" and "higher profits equals higher taxes" which Dr. Battsengel adds is "also good for the country."

One presenter slide at Cola Mongolia 2012 titled "Transportation Economics" posed the question: 100 trucks, 2 trains, or 1 vessel?

Mongolian Mining Corporation is confident Mongolia's coking coal prices will be competitive winners against Australia, the U.S., Canada, and Russia once railway connections are in place.

A Hundred Umbilical Cords To China

Mr. Battulga Khaltmaa is the charismatic man behind Mongolia's national railway plan. Mr. Battulga draws his wealth that places him among Mongolia's five richest men from Genco Group. He is also a member of parliament, and until a few months ago - when the Democrat Party abandoned the governing coalition - the Minister for Roads, Transport, Construction and Urban Development (shortened to Minister of Transportation for remainder of this article). He is a leading member of the opposition Democrat Party in Mongolia and among Mongolia's more popular politicians, and businessmen.

Mr. Battulga's Genco famously built a gigantic statue of Chinngis Khan (aka Ghengis Khan) one hour's drive from Ulaanbaatar. The statue has a museum inside, and is floodlit at night-- despite not being near any major town. It stoically - and symbolically - faces China.

This is the face of the statue looking right at China. Source: Wall Street Journal; Andrea Fazzari.

Here's the statue with a car, so you understand how big it is. Source: Lonely Planet.

When Mongolian Mining Corporation suggested they could build their own railway to China, Mr. Battulga in his capacity as Minister of Transportation advocated that this was a dangerous proposition that could lead to reliance on China, Chinese dominance of Mongolia's capital markets, and a hundred umbilical cords to China. People who live in Mongolia occasionally note while retelling this story that only a few years earlier, MCS's Mr. Odjargal had surpassed Mr. Battulga as Mongolia's wealthiest individual. Other sources counter that Mr. Battulga and Mr. Odjargal are on good terms as private citizens. In any case, Mr. Battulga's plan to protect national security from a hundred umbilical cords to China won over the parliament and is shown on the next map.

A photo of Mr. Battulga superimposed with a red light and railroad tracks. Source: Zindaa.mn.

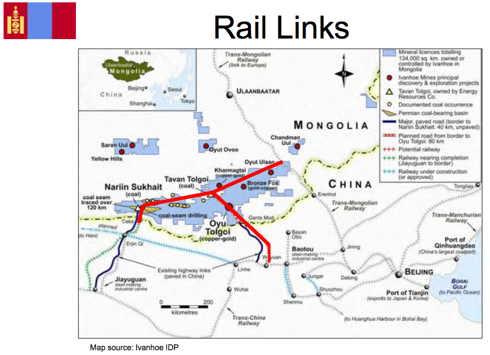

The national rail plan spearheaded by former Minister of Transporation Battulga. Notice that the yellow phase 1 focuses on a rail link to Russia and only phase 2 develops links to China. Source: Washington Post.

A serious problem with the national rail plan indicated above, which was approved by the Mongolian parliament in June 2010, is that it was supposed to begin in 2011 and it has not begun yet. As Dr. Battsengel noted in a separate interview with the UB Post about subsequent iterations, "The official policies and papers covering railway transports were passed in June 2011. But the implementations of these policies are currently in a stalemate."

The current talk is that phase 1 and phase 2 construction will occur simultaneously, but neither phase is being executed yet. As Mongolian Railways is 50% owned by Russia, Mongolia has set up a separate rail company to be 100% Mongolian owned, or possibly in part a publicly traded company, for the future rail construction.

A Few Questions

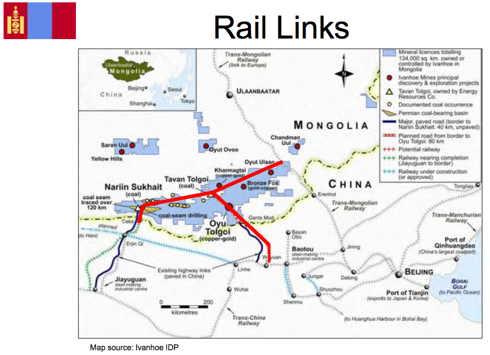

Below is a map from a January 2010 World Bank presentation. On the map you can clearly see Tavan Tolgoi (state run coal mine set to IPO this year, or next year, with 6.4 billion tonnes of coal reserves; currently ramping up to full capacity production), Oyu Tolgoi (the massive Ivanhoe (IVN) - Rio Tinto (RIO) copper-gold mine that will begin production later this year; 34% owned by the Mongolian government), and Nariin Sukhait (owned in a joint venture by Mongolyn Alt, the next biggest private company tax payer in Mongolia after MCS Group).

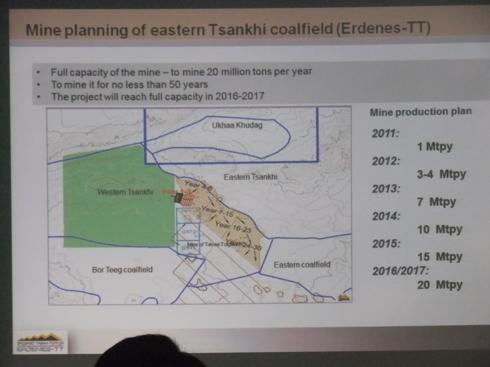

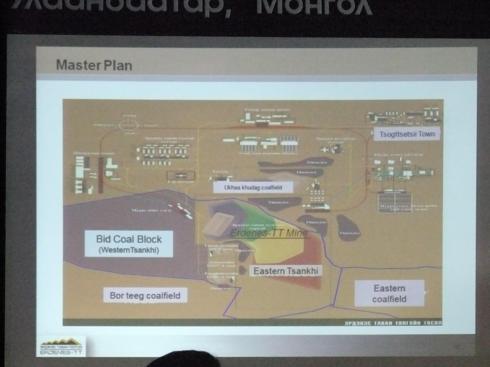

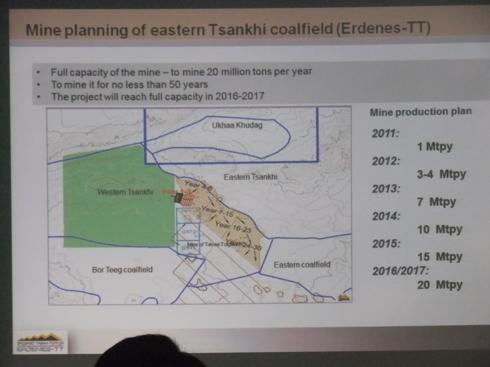

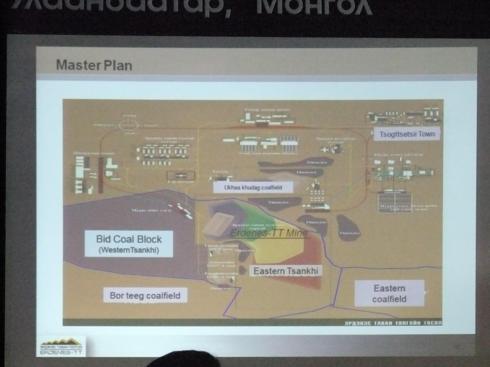

The reason you do not see Mongolian Mining Corporation's Ukhaa Khudag on the above map is because it is actually part of the same deposit area as the Tavan Tolgoi deposit. The next two pictures are from the presentation of Erdenes MGL Tavan Tolgoi (Big TT) at Coal Mongolia 2012. Big TT is the above-mentioned state-run company seeking to IPO 30% of its shares internationally in Hong Kong and London later this year or next year. Mongolian Mining Corporation's Ukhaa Khudag deposit is at the top of both of these slides, a bit off to the right.

The government - via Big TT - currently owns the "Bid Coal Block" (Western Tsankhi) and the Eastern Tsankhi. The government plans to sell the Western Tsankhi deposit, a bidding process in which Peabody (BTU) and China Shenhua (CSUAY.PK) have been active, among others. There is another mine in the same area listed on the Mongolian Stock Exchange which is referred to locally as Little TT, to differentiate from state-run Big TT that owns the Eastern and Western Tsankhi deposits currently.

The Oyu Tolgoi and Big TT deposits - the largest undeveloped copper and coal deposits in the country respectively - are supposed to jointly lead Mongolia's GDP growth through 2020 and beyond.

At the Coal Mongolia 2012 conference four separate question and answer sessions began with a member of the audience asking when railway infrastructure would be put into place. Would tax revenues be higher if all these Mongolian companies near the border could transport their natural resources to China by rail instead of by truck? Yes. Would there be a risk that the companies would then only export to China creating a non-competitive environment for their resources? Yes, but... Could the additional tax revenues from all these companies additional profits by selling their resources to China via rail (instead of truck) thereafter be used to build out Mongolia's rail infrastructure to be able to access other markets via Russia? It seems likely.

Does the author fully understand the geopolitical risks and negotiations of Mongolia, a country with only two neighbors which happen to be Russia and China? No. The Mongolian nation has been negotiating how to manage these two relationships for a long time.

The bottom line question is why the government - which owns the huge Tavan Tolgoi deposit that has been intended for years to be the government jewel, which each Mongolian citizen is to receive a pre-IPO share stake in; and which is to internationally IPO to promote investment in Mongolia and raise money for the government, as well as the state-run company - has not coordinated rail infrastructure development with Mongolian Mining Corporation when the two companies are essentially on the same propert. Moreover, the IPO share price of Big TT would be much higher if the rail infrastructure were already in place?

(On top of that, a rail line to China's industrial center of Batou from the greater TT area would go right by Oyu Tolgoi, 34% owned by the government, as well. Oyu Tolgoi will begin production in the second half of this year without a rail link to China in place.)

Nevertheless, Mongolian Mining Corporation Improves Transportation Conditions

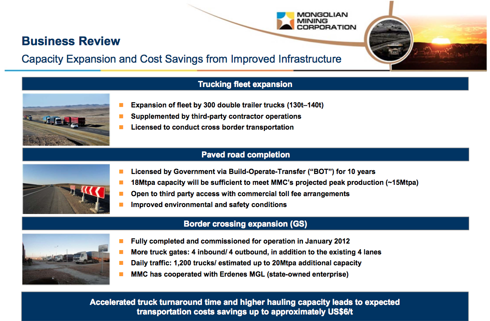

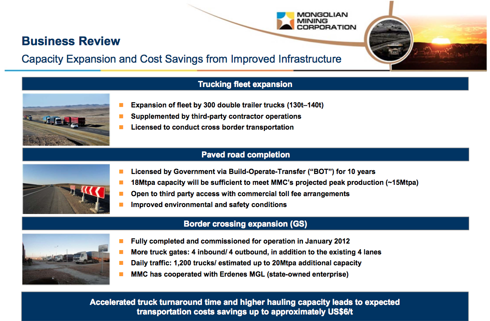

One thing pointed out by many local brokerages in Mongolia when we discuss Mongolian Mining Corporation is that their relationship with Chinese customers is excellent. Another thing to like is the company is not hung up on waiting for the railroad infrastructure development that has stalled in the halls of Mongolia's parliament. Instead, they have aggressively expanded their trucking capacity and roadway capacity. Their estimate suggests that projects completed in calendar year 2011 through January 2012 will save $6 per ton in transportation costs to China going forward.

Source: Mongolian Mining Corporation 2011 Annual Results presentation (dated March 7, 2012).

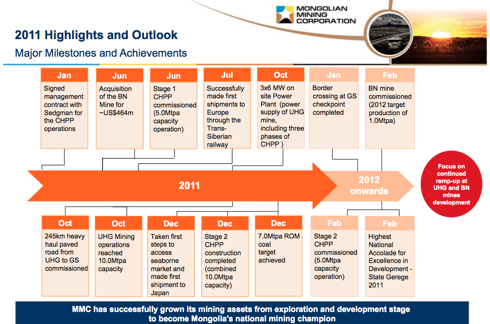

While focused on the cost effectiveness of exports to China, Mongolian Mining Corporation understands the concerns of some members of government that a diverse portfolio of customers is necessary to Mongolia's success. Among Mongolian Mining Corporation's achievements for calendar year 2011 were successful export shipments to Europe in July 2011 and Japan in December 2011.

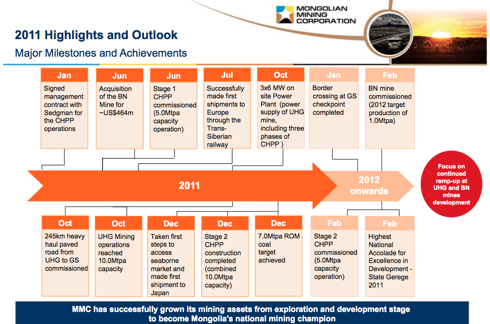

Source: Mongolian Mining Corporation 2011 Annual Results presentation (dated March 7, 2012).

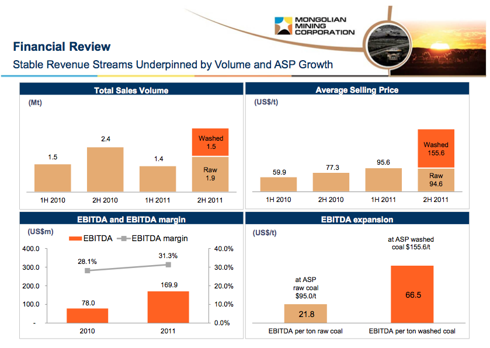

Bloomberg noted on March 6, 2012, "Profit [for Mongolian Mining Corporation] rose 98 percent to $119.1 million last year, matching the average $118.7 million estimate of six analysts in a survey compiled by Bloomberg. Revenue climbed 96 percent to $542.6 million, the Hong Kong-listed company reported today." Following the release of the company's annual results, on March 12, Yiannis Mostrous, who has co-authored a book on Asian investing with regular Seeking Alpha contributor Elliot Gue, wrote a bullish article on Mongolian Mining Corporation. Previously, in November 2011 I discussed Mongolian Mining Corporation at length in my article overviewing the coal investment opportunities in Mongolia.

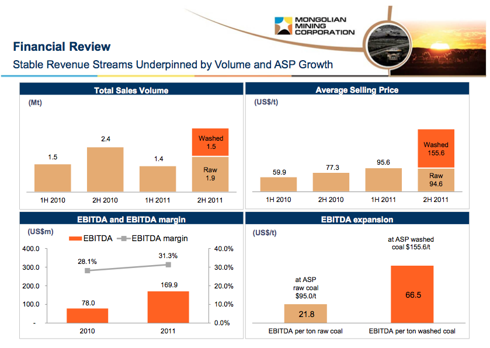

Source: Mongolian Mining Corporation 2011 Annual Results presentation (dated March 7, 2012).

Washing Up

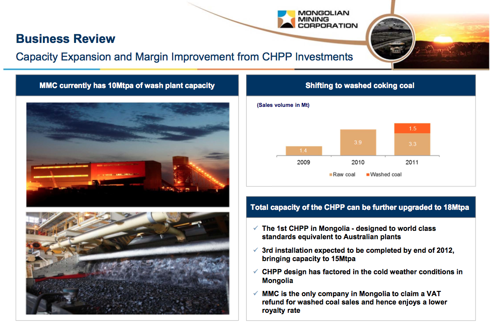

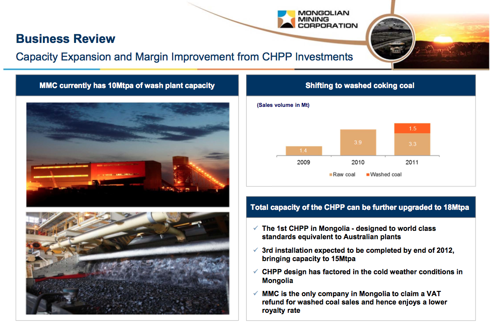

A big development in the company's profitability has been the on-schedule construction of coal washing facilities. The second of three Coal Handling and Preparation Plants [CHPPs] was commissioned in February 2012 bringing capacity up to 10 million tonnes per year. The third is to be completed by early 2013. Each of three planned CHPPs - one of which is operating since last year - are for processing 5 million tonnes per year based on 6,000 operating hours at 850 tonnes per hour. They believe it is possible to get efficiencies out of the CHPPs that will allow them to process 6 million tonnes per year at each CHPP in the future.

Source: Mongolian Mining Corporation 2011 Annual Results presentation (dated March 7, 2012).

The improved profits with the washed coal is noteworthy. It cuts down transportation costs as only coal and no rock (or overburden) is transported. There is more competition among customers for the washed coal. The cost per tonne to wash the coal is $3 while the sale price per tonne improves about 63% (e.g. from raw coal to China at $94.60 per tonne to washed coal to China at $155.60 per tonne). Also, all the washing plants are built for year-round operations (which is not always the case for facilities in Mongolia, where winter temperatures go down to minus 40).

Source: Mongolian Mining Corporation 2011 Annual Results presentation (dated March 7, 2012).

On top of this, the Mongolian government is encouraging companies to invest in the country and sell their product at higher prices. Thus, the government royalty on the washed coal produced by Mongolian Mining Corporation is lower than the royalty on raw coal, and the company can claim back Mongolia's 10% VAT (value added tax) thus nudging profits higher.

Strategic Acquisitions And Improvements

Last year, the company strategically acquired the Baruun Naraan deposit, 30 kilometers (18 miles) away from Ukhaa Khudag. Dr. Battsengel explains that with Baruun Naraan, the company was "looking for a property close to production so we could ramp it up quickly."

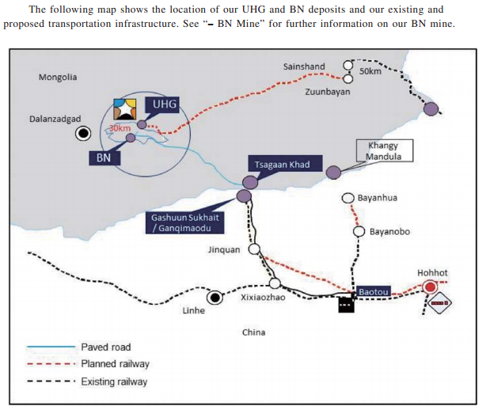

Gray area is Mongolia. White area is China. BN = Baruun Naraan. UHG= Ukhaa Khudag. Page 98, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012 (this report is 100s of pages with appendixes; dig in to the linked report for up-to the date everything-you-need-to-know data).

The company is investigating purchasing properties still in the exploration stage which have higher upside. The company is in no hurry to expand its resources and feels they have the next five years to look for opportunities to purchase assets.

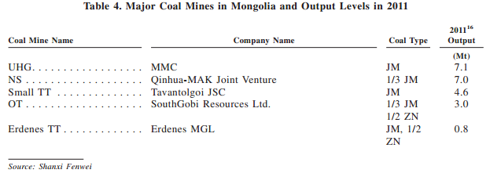

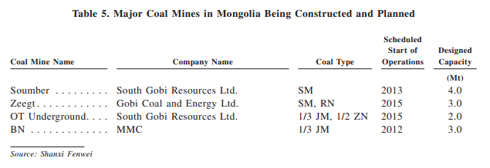

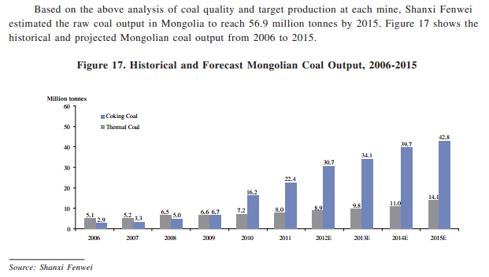

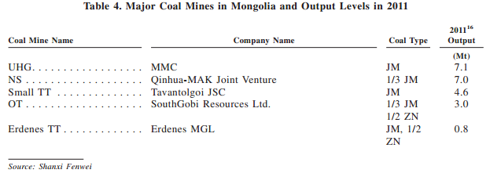

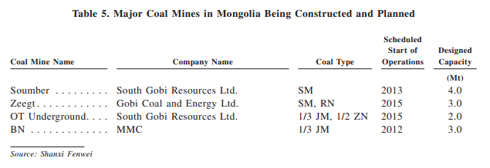

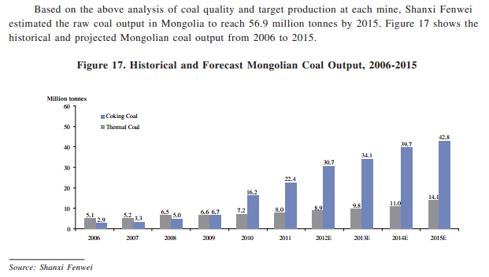

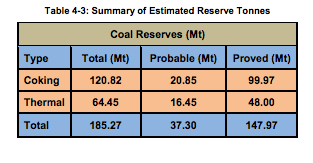

The next two tables show the production of operating mines in the South Gobi of Mongolia in 2011, and the future of those mines coming on line in the next few years. The third table shows historical and forecast production of coal in Mongolia.

Key to table. UHG = Ukhaa Khudag, Mongolian Mining Corporation (MOGLF.PK), NS = Nariin Sukhait, Qinhua-Mongolyn Alt joint venture, Small TT = Little Tavan Tolgoi (listed on Mongolia Stock Exchange), OT = SouthGobi Resources (SGQRF.PK), Erdennes TT = Big Tavan Tolgoi. Page 79, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012.

Key to table. Soumber = SouthGobi Resources (SGQRF.PK). Zeegt = Gobi Coal and Energy (to IPO this year in Canada), OT Underground = SouthGobi Resources (SGQRF.PK), BN = Baruun Naraan, Mongolian Mining Corporation (MOGLF.PK) Page 80, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012.

Page 80, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012.

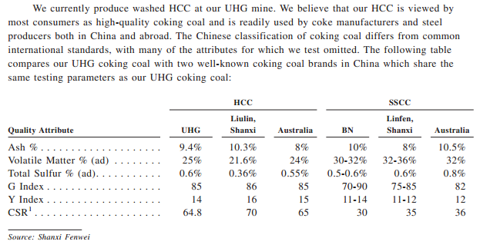

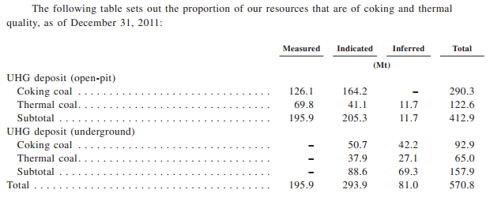

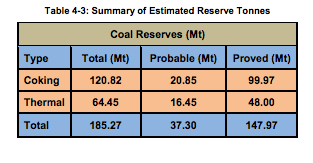

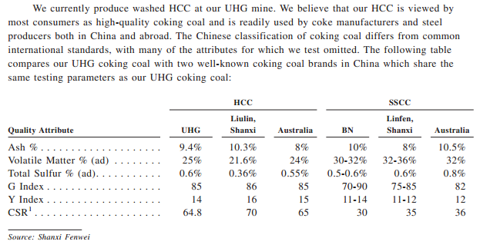

In the next few tables from the same report, there are few other things to address. First, it is a misnomer that the company only produces coking coal. Ukhaa Khudag has both hard coking coal [HCC] and thermal coal, while Baruun Naraan is mainly producing semi-soft coking coal [SSCC]. I will not go into the outlook for Mongolian Mining Corporation's thermal coal in this article, as it is the coking coal that is the principal driver of profitability. However, for a good overview of the thermal coal sector in Mongolia, I recommend Leo Liu's article on regional energy demand around Mongolia.

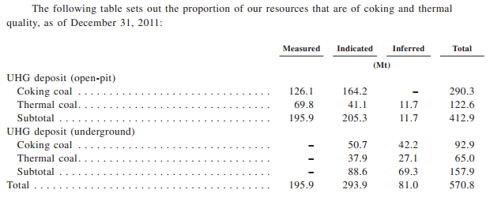

Page 103, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012.

Ukhaa Khudag Deposit overview. Page 101, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012.

Baruun Naraan Deposit overview. Page C19, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012.

Mongolian Mining Corporation continues to seek ways and means to grow. On March 14, 2012, the company announced they were proposing $300 million in senior notes due in 2017," for the following purposes:

UHG is the company's shorthand for their Ukhaa Khudag deposit and GS stands for Gashuun Sukhait, the town at the border crossing with China.

Outlook For Mongolia In Context

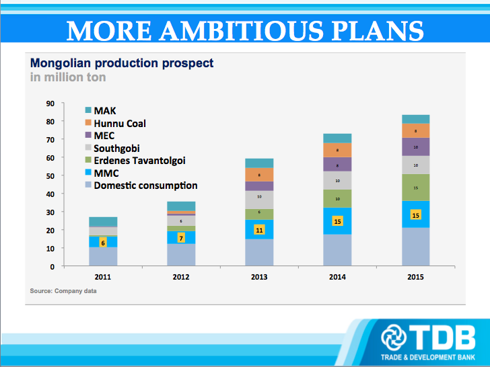

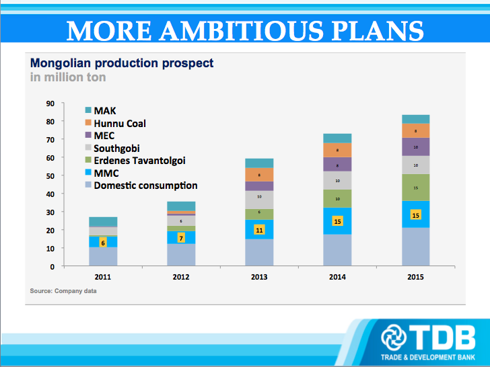

Projected coal production by company in Mongolia. MAK is privately held Mongolyn Alt. Hunnu is now a subsidiary of Banpu (BNPJF.PK). MEC is Mongolia Energy Company (MOAEY.PK). SouthGobi is SouthGobi Resources (SGQRF.PK). Erdenes Tavan Tolgoi is Big TT. MMC is Mongolian Mining Corporation (MOGLF.PK). Source: Trade and Development Bank presentation at Coal Mongolia 2012 by Randolph Koppa.

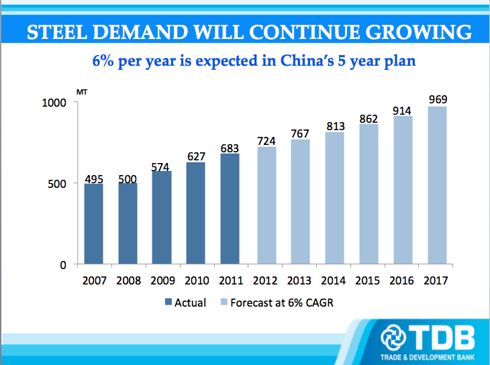

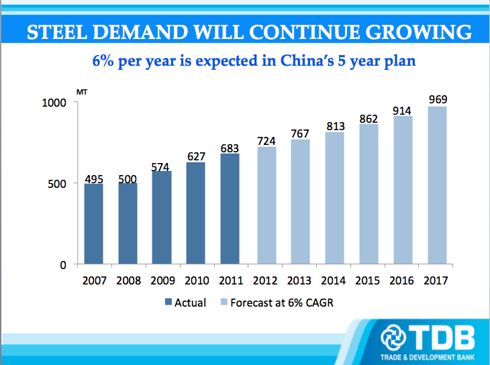

Rising demand in China. Source: Trade and Development Bank presentation at Coal Mongolia 2012 by Randolph Koppa.

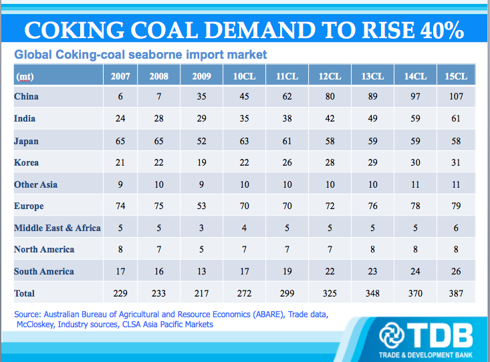

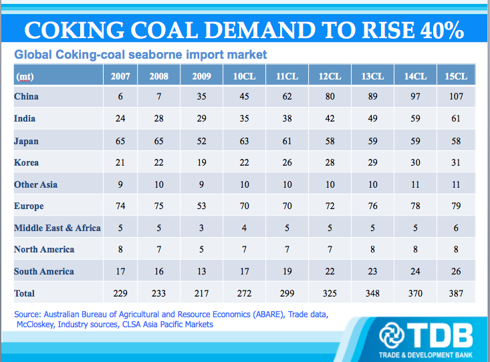

Rising global demand. Source: Trade and Development Bank presentation at Coal Mongolia 2012 by Randolph Koppa.

Conclusion

As several presenters at Coal Mongolia 2012 pointed out, Northeastern Asian countries -- including Korea, Japan and China -- accounted for nearly 40% of the 1 billion ton coal trade in 2011, and India is coming along to join those countries in that demand.

Mongolian Mining Corporation is well positioned to fully profit from marketplace demand and geographically well positioned near China, where the greatest demand is. The company continues to develop washing facilities, ramp up operations, expand export efficiency, seek out strategic acquisitions, and in many ways, find the means to improve profitability.

I have made two trips to Mongolia and plan to return in the fall because Mongolia is supposed to be one of the best performing markets to invest in through at least 2020, and perhaps longer. The information one hears from people locally is different than data you can read in the news media. MCS Group and Mongolian Mining Corporation have positioned themselves well to be at the forefront both of Mongolia's growing economy, and leading examples of well-run Mongolian companies. I expect Mongolian Mining Corporation to produce steady, reasonable and reliable returns to investors over time.

Disclosure: I am long IVN.

Additional disclosure: I will make an initial purchase of Mongolian Mining Corporation shares one week after this article is published with an eye to accumulating shares over time.

This article is based on data from an interview with Mongolian Mining Corporation CEO Dr. Battsengel Gotov on February 13, 2012, data gathered attending Coal Mongolia 2012 February 9 and 10, 2012, trips by the author to Mongolia in September 2011 and February 2012, and a review of recent Mongolian Mining Corporation activity and news.

In two trips to Mongolia, I have met with eight different locally run brokerage companies and a host of other investment professionals. I always try to find out what companies they like, what companies they don't like, and why. From this informal survey, Mongolian Mining Corporation (MOGLF.PK) always scores the highest. The reasons cited for this acclamation sound almost boring: "they don't over-promise," "they always do what they say they are going to do," "they have good relationships with their customers," "there is good transparency in their announcements and reports," "it's a well run company."

Mongolian Mining Corporation is Mongolia's premier publicly listed company and its primary owner is Mongolia's largest private company. The company is intimately tied to the economy, politics and business practices of Mongolia, and this report seeks to cover these angles to provide a deeper perspective both on the company and its home country.

Meet The Children Companies, Meet The Parent Company

Mongolian Mining Corporation is the full 100% owner of Energy Resources LLC, which is best observed on the below ownership chart from Mongolia Mining Corporation. This is need-to-know information as articles about Mongolia frequently cite Energy Resources without mention of Mongolian Mining Corporation.

Click to enlarge this and all other graphics in this article. Source: Mongolia Mining Coporation.

The biggest shareholder of Mongolian Mining Corporation is the company's original parent, MCS Group, a privately held Mongolian based conglomerate. MCS Group at last report owns 43.45% of Mongolian Mining Corporation. A quick perusal of the top 100 tax-paying companies in Mongolia for 2011 will find the list littered with MCS and Energy Resources subsidiaries at rankings 6, 13, 18, 23, 33, 43, 55, 64, 67, 73 and 77. The UB Post noted in a review of the very top of the top 100 companies:

MCS was founded in 1993 as a small energy consultant; today it stands as the second biggest company in Mongolia in terms of contribution to the Mongolian economy and social responsibility. With 15 subsidiaries, it has a diverse area of operation in the Mongolian economy such as energy infrastructure, mining, cashmere production, food and beverages, information communications, property development and general services. Currently, the MCS Group employs over 3,000 employees. According to the [World Bank's] International Finance Corporation summary, MCS group will create permanent full time jobs for over 500 people each year with an additional 1,000 indirect jobs through its contractors over the next 3 years. MCS Group is among the top tax-payers of Mongolia, winning consecutive awards and recognitions from the Mongolian Government since 1999. They include Best Company of the year, Best Tax payer of the Year, Best Corporate Social Responsibility. The company has remained at the second place in Mongolia's Top 100 companies since 2005, behind only [state-run copper producer] Erdenet Mining Corporation.Moreover, MCS and Mongolian Mining Corporation take their roles in the society seriously. From distributing smokeless stoves to combat the pollution in Mongolia's capital of Ulaanbaatar to pursuing best environmental and sustainability practices for their mines, the companies of MCS seem to be conscious of being in a position to lead their country by example. They take on that responsibility with the same effort they apply to improving profitability. There is also the impression that those at MCS and its subsidiaries recognize people outside of Mongolia will see what they do as an example of how Mongolians do business and hold themselves to the most exemplar standards.

A specific example that can be pointed to regarding MCS's responsible development is real estate development practices. In a conversation with one local real estate professional about Ulaanbaatar's development, we were studying a wall-size map of the city and looking at spaces left for development. Ulaanbaatar is a city where a protected national park reserve now is covered with apartment buildings and nearly every green area is owned by someone planning to develop it. Unprompted, this real estate professional began comparing the large Mongolian conglomerates use of land:

This conversation aided by the map continued for about 30 minutes. Conglomerate X was the worst in the view of this real estate professional and MCS was the best. For the record, the laws on the books (which are generally ignored) say development of property in the city are supposed to leave 30% green spaces, as MCS does. Meanwhile, conglomerate X is believed to own the biggest green space left in the center of the city."See that, 30% of the land is green, that's MCS.

See that, no green space, that's [conglomerate X]

[points to another] No green space, that's [conglomerate Y]

[another] 30% green space, that's MCS.

[another] No green space [conglomerate Z]

[another] 30% green space, that's MCS.

[another] No green space [conglomerate X, again]"

Central Tower, the building housing MCS and Mongolian Mining Corporation's primary offices has green space on its land. Source: author's camera.

MCS group's most recognizable subsidiary to westerners is Coca-Cola Mongolia, which began under their management in 2002. Conversations with people outside the company reveal that there was a learning curve after MCS became a member of the Coca-Cola (KO) family that ultimately drove the company to higher standards and more sophisticated interactions with capital markets. The company was well-run before, more globally savvy and astute after.

Mr. Odjargal Jambaljamts, Chairman and CEO of MCS, who is also Chairman of Mongolian Mining Corporation, celebrates Mongolian Mining Corporation's IPO in Hong Kong. Source: Day Life.

Chairman and CEO of MCS Group Odjargal Jambaljamts is widely believed to be the wealthiest person in Mongolia and among Mongolia's handful of billionaires. However, Mr. Odjargal and his companies have a reputation for not being flashy organizations. When an elevator opens on any random floor of MCS business operations, one sees a scene of sharp-dressed men and women in suits moving with purpose. From casual conversation with Mongolians from many backgrounds, a serious and hard-working ethic comes from the top of the organization.

Meet The CEO of Mongolian Mining Corporation

In this recent interview on Bloomberg TV, readers can meet Dr. Battsengel, CEO of Monglian Mining Corporation. There is a culture clash in this interview between the televised financial media that is geared to fast-talking boisterous sales and marketing CEOs, and the culture of Dr. Battsengel and his company to state only what is knowable or definitively possible to execute.

Mongolian Mining Corporation's sales pitch is simple: they execute their business as best as possible, period. In a vein Benjamin Graham would appreciate, Mongolian Mining Corporation management assumes that markets are rational and will recognize the value in their company sooner or later. They leave that job to the markets, and focus on their job-- running the best business possible.

I first met Dr. Battsengel at the Coal Mongolia 2012 conference where he was a distinguished speaker during two sessions including the concluding panel discussion.

We subsequently met for an interview at Dr. Battsengel's office overlooking Sukhbaatar Square and the Mongolian Government Palace (where the State Great Khural - Mongolia's parliament - meets). Dr. Battsengel is calm, understated, and thoughtful in his responses to questions. Dr. Battsengel is significantly taller than my own 6'2" (188 cm) frame. He diplomatically answers questions related to other companies and political developments. Many questions were answered by him with a statement that can also be found on the company's website, in its presentation and reports: the company works to be transparent with all investors.

Location, Location, Location

The rules of real estate often apply to mining as well. Proximity to infrastructure and customers lowers the cost of doing business. By the location of its primary Ukhaa Khudag mine (pointed out by the blue arrow below), the natural customer is China (approximately, 250 km or 150 miles, from mine to border).

Ukhaa Khudag deposit, measuring 2,960 hectares in size, holds 497 million tons and 283 million tons of JORC-compliant measured and indicated coal resources and proven and probable reserves, respectively as of May 31, 2010. According to Wood Mackenzie, the vast majority of our reserves are high quality hard coking coal, increasingly high in demand at steel, iron mills and chemical plants across the border in China.

From the Energy Resources LLC presentation at Coal Mongolia 2012. Blue arrow added by author.

However, despite proximity to China, Mongolian Mining Corporation has tested exports to other countries as well. By the numbers, transport costs per tonne to respective countries:

- China = $23 (dropping to $20 with new roadways the company made and opened in 2011)

- Japan (via the port of Nahodka in Russia) = $170

- Germany (actually to a German company location in Poland) = $190

- China = $155.60 (washed at Gants Mod, border town)

- Japan = $282 price agreed circa Q32012 (washed FOB Nakhodka, port in Russia; $282 was "comparable to Australia FOB prices at that time"; "current seaborne market prices are much weaker, 200-220 USD/t FOB Australia, making such distant shipments not economical at all")

- Germany = $345 circa July/August 2011 ($155 washed at FCA Choir, town connecting to Mongolian railway in Mongolia; plus $190 transportation cost; "345 USD/t in July/August 2011, comparable to prices in Europe at that time; small amount, around 3.5kt (48 wagons) to Thyssen Krupp (TYEKF.PK); was a trial shipment, some loss in margins taken as an investigation cost")

From the Energy Resources LLC presentation at Coal Mongolia 2012.

Meanwhile, it is believed that Mongolian market share of China's coal imports will grow as China's need to import coal continues to grow as well. The macro outlook for coal from Mongolia vis-a-vis the relationship with China was previously discussed in an earlier article I wrote.

Dr. Battsengel points out that China is a big producer of coking coal, but on a per capita basis is still small, and demand for coking coal from China is set to peak between 2015 and 2020. "Because Chinese demand is increasing, we need to secure our market share. The market will be there, no problem," he says. At the same time, Mongolia's coking coal production is anticipated to start peaking in 2016 coinciding well with Chinese demand.

Dr. Battsengel believes Chinese demand for coking coal imports could grow up to 70 million tonnes and that by 2015 Mongolia could supply up to 50 million tonnes of that demand.

From the Energy Resources LLC presentation at Coal Mongolia 2012. In the first two pie charts, the rust-colored part of the pie chart sticking out is Mongolia's share of the Chinese market. The prediction for 2015 is a 52% share of the Chinese market.

Part 2 - Transportation Issues

The Tracks Of A Transportation DramaGoing back to 2009, Mongolian Mining Corporation has been prepared with a feasibility study on a rail link to China. The railway to China from near Ukhaa Khudag has been blocked by the national plan to develop the railways spearheaded by a popular and charismatic politician who also happens to be among Mongolia's five richest men.

To understand this, a brief history is required. Mongolia became the 2nd communist country in the world in 1921 and operated in close relationship with the Soviet Union through 1991, before embracing democracy enthusiastically since that time. As a result of its earlier history, Mongolia's rail network is 50% owned by today's Russia and is Russian gauge. China's railways are on the same international standard gauge found in Europe, the U.S., Australia, and 60% of the world. The difference in which rail gauge Mongolia uses for its links to China is between $30 and $60 million per year.

Source: Wikipedia.

From Mr. Enkhbaatar's presnetation for MINIS at Coal Mongolia 2012. The second to last bullet point notes the cost of changing from Mongolia's Russian gauge to China's standard gauge tracks at the border is $30 million to $60 million per year.

Dr. Battsengel would not address the various controversies and delays to Mongolia developing its rail infrastructure in our meeting. However, despite national elections this June, Dr. Battsengel believes "construction for the rail project must start this year" and believes a "decision will be made in the first half of this year."

While some are concerned about over-dependence on China creating lower sales prices for Mongolian resources, Dr. Battsengel views their Chinese clients as "practical." The Chinese know if they squeeze the price of Mongolian resources too much, Mongolians will turn elsewhere. Instead, there is and should be a mutual relationship that is beneficial for both sides.

Dr. Battsengel points out that when you look at the costs of trucking compared to rail, it behooves everyone to make the rail project happen. The "extra profits will stay in the country" and "higher profits equals higher taxes" which Dr. Battsengel adds is "also good for the country."

One presenter slide at Cola Mongolia 2012 titled "Transportation Economics" posed the question: 100 trucks, 2 trains, or 1 vessel?

Mongolian Mining Corporation is confident Mongolia's coking coal prices will be competitive winners against Australia, the U.S., Canada, and Russia once railway connections are in place.

A Hundred Umbilical Cords To China

Mr. Battulga Khaltmaa is the charismatic man behind Mongolia's national railway plan. Mr. Battulga draws his wealth that places him among Mongolia's five richest men from Genco Group. He is also a member of parliament, and until a few months ago - when the Democrat Party abandoned the governing coalition - the Minister for Roads, Transport, Construction and Urban Development (shortened to Minister of Transportation for remainder of this article). He is a leading member of the opposition Democrat Party in Mongolia and among Mongolia's more popular politicians, and businessmen.

Mr. Battulga's Genco famously built a gigantic statue of Chinngis Khan (aka Ghengis Khan) one hour's drive from Ulaanbaatar. The statue has a museum inside, and is floodlit at night-- despite not being near any major town. It stoically - and symbolically - faces China.

This is the face of the statue looking right at China. Source: Wall Street Journal; Andrea Fazzari.

Here's the statue with a car, so you understand how big it is. Source: Lonely Planet.

When Mongolian Mining Corporation suggested they could build their own railway to China, Mr. Battulga in his capacity as Minister of Transportation advocated that this was a dangerous proposition that could lead to reliance on China, Chinese dominance of Mongolia's capital markets, and a hundred umbilical cords to China. People who live in Mongolia occasionally note while retelling this story that only a few years earlier, MCS's Mr. Odjargal had surpassed Mr. Battulga as Mongolia's wealthiest individual. Other sources counter that Mr. Battulga and Mr. Odjargal are on good terms as private citizens. In any case, Mr. Battulga's plan to protect national security from a hundred umbilical cords to China won over the parliament and is shown on the next map.

A photo of Mr. Battulga superimposed with a red light and railroad tracks. Source: Zindaa.mn.

The national rail plan spearheaded by former Minister of Transporation Battulga. Notice that the yellow phase 1 focuses on a rail link to Russia and only phase 2 develops links to China. Source: Washington Post.

A serious problem with the national rail plan indicated above, which was approved by the Mongolian parliament in June 2010, is that it was supposed to begin in 2011 and it has not begun yet. As Dr. Battsengel noted in a separate interview with the UB Post about subsequent iterations, "The official policies and papers covering railway transports were passed in June 2011. But the implementations of these policies are currently in a stalemate."

The current talk is that phase 1 and phase 2 construction will occur simultaneously, but neither phase is being executed yet. As Mongolian Railways is 50% owned by Russia, Mongolia has set up a separate rail company to be 100% Mongolian owned, or possibly in part a publicly traded company, for the future rail construction.

A Few Questions

Below is a map from a January 2010 World Bank presentation. On the map you can clearly see Tavan Tolgoi (state run coal mine set to IPO this year, or next year, with 6.4 billion tonnes of coal reserves; currently ramping up to full capacity production), Oyu Tolgoi (the massive Ivanhoe (IVN) - Rio Tinto (RIO) copper-gold mine that will begin production later this year; 34% owned by the Mongolian government), and Nariin Sukhait (owned in a joint venture by Mongolyn Alt, the next biggest private company tax payer in Mongolia after MCS Group).

The reason you do not see Mongolian Mining Corporation's Ukhaa Khudag on the above map is because it is actually part of the same deposit area as the Tavan Tolgoi deposit. The next two pictures are from the presentation of Erdenes MGL Tavan Tolgoi (Big TT) at Coal Mongolia 2012. Big TT is the above-mentioned state-run company seeking to IPO 30% of its shares internationally in Hong Kong and London later this year or next year. Mongolian Mining Corporation's Ukhaa Khudag deposit is at the top of both of these slides, a bit off to the right.

The government - via Big TT - currently owns the "Bid Coal Block" (Western Tsankhi) and the Eastern Tsankhi. The government plans to sell the Western Tsankhi deposit, a bidding process in which Peabody (BTU) and China Shenhua (CSUAY.PK) have been active, among others. There is another mine in the same area listed on the Mongolian Stock Exchange which is referred to locally as Little TT, to differentiate from state-run Big TT that owns the Eastern and Western Tsankhi deposits currently.

The Oyu Tolgoi and Big TT deposits - the largest undeveloped copper and coal deposits in the country respectively - are supposed to jointly lead Mongolia's GDP growth through 2020 and beyond.

At the Coal Mongolia 2012 conference four separate question and answer sessions began with a member of the audience asking when railway infrastructure would be put into place. Would tax revenues be higher if all these Mongolian companies near the border could transport their natural resources to China by rail instead of by truck? Yes. Would there be a risk that the companies would then only export to China creating a non-competitive environment for their resources? Yes, but... Could the additional tax revenues from all these companies additional profits by selling their resources to China via rail (instead of truck) thereafter be used to build out Mongolia's rail infrastructure to be able to access other markets via Russia? It seems likely.

Does the author fully understand the geopolitical risks and negotiations of Mongolia, a country with only two neighbors which happen to be Russia and China? No. The Mongolian nation has been negotiating how to manage these two relationships for a long time.

The bottom line question is why the government - which owns the huge Tavan Tolgoi deposit that has been intended for years to be the government jewel, which each Mongolian citizen is to receive a pre-IPO share stake in; and which is to internationally IPO to promote investment in Mongolia and raise money for the government, as well as the state-run company - has not coordinated rail infrastructure development with Mongolian Mining Corporation when the two companies are essentially on the same propert. Moreover, the IPO share price of Big TT would be much higher if the rail infrastructure were already in place?

(On top of that, a rail line to China's industrial center of Batou from the greater TT area would go right by Oyu Tolgoi, 34% owned by the government, as well. Oyu Tolgoi will begin production in the second half of this year without a rail link to China in place.)

Nevertheless, Mongolian Mining Corporation Improves Transportation Conditions

One thing pointed out by many local brokerages in Mongolia when we discuss Mongolian Mining Corporation is that their relationship with Chinese customers is excellent. Another thing to like is the company is not hung up on waiting for the railroad infrastructure development that has stalled in the halls of Mongolia's parliament. Instead, they have aggressively expanded their trucking capacity and roadway capacity. Their estimate suggests that projects completed in calendar year 2011 through January 2012 will save $6 per ton in transportation costs to China going forward.

Source: Mongolian Mining Corporation 2011 Annual Results presentation (dated March 7, 2012).

While focused on the cost effectiveness of exports to China, Mongolian Mining Corporation understands the concerns of some members of government that a diverse portfolio of customers is necessary to Mongolia's success. Among Mongolian Mining Corporation's achievements for calendar year 2011 were successful export shipments to Europe in July 2011 and Japan in December 2011.

Source: Mongolian Mining Corporation 2011 Annual Results presentation (dated March 7, 2012).

Part 3 - Growth Company

Growing CompanyBloomberg noted on March 6, 2012, "Profit [for Mongolian Mining Corporation] rose 98 percent to $119.1 million last year, matching the average $118.7 million estimate of six analysts in a survey compiled by Bloomberg. Revenue climbed 96 percent to $542.6 million, the Hong Kong-listed company reported today." Following the release of the company's annual results, on March 12, Yiannis Mostrous, who has co-authored a book on Asian investing with regular Seeking Alpha contributor Elliot Gue, wrote a bullish article on Mongolian Mining Corporation. Previously, in November 2011 I discussed Mongolian Mining Corporation at length in my article overviewing the coal investment opportunities in Mongolia.

Source: Mongolian Mining Corporation 2011 Annual Results presentation (dated March 7, 2012).

Washing Up

A big development in the company's profitability has been the on-schedule construction of coal washing facilities. The second of three Coal Handling and Preparation Plants [CHPPs] was commissioned in February 2012 bringing capacity up to 10 million tonnes per year. The third is to be completed by early 2013. Each of three planned CHPPs - one of which is operating since last year - are for processing 5 million tonnes per year based on 6,000 operating hours at 850 tonnes per hour. They believe it is possible to get efficiencies out of the CHPPs that will allow them to process 6 million tonnes per year at each CHPP in the future.

Source: Mongolian Mining Corporation 2011 Annual Results presentation (dated March 7, 2012).

The improved profits with the washed coal is noteworthy. It cuts down transportation costs as only coal and no rock (or overburden) is transported. There is more competition among customers for the washed coal. The cost per tonne to wash the coal is $3 while the sale price per tonne improves about 63% (e.g. from raw coal to China at $94.60 per tonne to washed coal to China at $155.60 per tonne). Also, all the washing plants are built for year-round operations (which is not always the case for facilities in Mongolia, where winter temperatures go down to minus 40).

Source: Mongolian Mining Corporation 2011 Annual Results presentation (dated March 7, 2012).

On top of this, the Mongolian government is encouraging companies to invest in the country and sell their product at higher prices. Thus, the government royalty on the washed coal produced by Mongolian Mining Corporation is lower than the royalty on raw coal, and the company can claim back Mongolia's 10% VAT (value added tax) thus nudging profits higher.

Strategic Acquisitions And Improvements

Last year, the company strategically acquired the Baruun Naraan deposit, 30 kilometers (18 miles) away from Ukhaa Khudag. Dr. Battsengel explains that with Baruun Naraan, the company was "looking for a property close to production so we could ramp it up quickly."

Gray area is Mongolia. White area is China. BN = Baruun Naraan. UHG= Ukhaa Khudag. Page 98, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012 (this report is 100s of pages with appendixes; dig in to the linked report for up-to the date everything-you-need-to-know data).

The company is investigating purchasing properties still in the exploration stage which have higher upside. The company is in no hurry to expand its resources and feels they have the next five years to look for opportunities to purchase assets.

The next two tables show the production of operating mines in the South Gobi of Mongolia in 2011, and the future of those mines coming on line in the next few years. The third table shows historical and forecast production of coal in Mongolia.

Key to table. UHG = Ukhaa Khudag, Mongolian Mining Corporation (MOGLF.PK), NS = Nariin Sukhait, Qinhua-Mongolyn Alt joint venture, Small TT = Little Tavan Tolgoi (listed on Mongolia Stock Exchange), OT = SouthGobi Resources (SGQRF.PK), Erdennes TT = Big Tavan Tolgoi. Page 79, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012.

Key to table. Soumber = SouthGobi Resources (SGQRF.PK). Zeegt = Gobi Coal and Energy (to IPO this year in Canada), OT Underground = SouthGobi Resources (SGQRF.PK), BN = Baruun Naraan, Mongolian Mining Corporation (MOGLF.PK) Page 80, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012.

Page 80, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012.

In the next few tables from the same report, there are few other things to address. First, it is a misnomer that the company only produces coking coal. Ukhaa Khudag has both hard coking coal [HCC] and thermal coal, while Baruun Naraan is mainly producing semi-soft coking coal [SSCC]. I will not go into the outlook for Mongolian Mining Corporation's thermal coal in this article, as it is the coking coal that is the principal driver of profitability. However, for a good overview of the thermal coal sector in Mongolia, I recommend Leo Liu's article on regional energy demand around Mongolia.

Page 103, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012.

Ukhaa Khudag Deposit overview. Page 101, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012.

Baruun Naraan Deposit overview. Page C19, Proposed Issue of Guaranteed Senior Notes announcement by Mongolian Mining Corporation, March 14, 2012.

Mongolian Mining Corporation continues to seek ways and means to grow. On March 14, 2012, the company announced they were proposing $300 million in senior notes due in 2017," for the following purposes:

- for financing transportation infrastructure improvement and development projects, including, without limitation, for our UHG-GS railway project;

- for working capital and other general corporate purposes, including, without limitation, for exploration and debt refinancing.

UHG is the company's shorthand for their Ukhaa Khudag deposit and GS stands for Gashuun Sukhait, the town at the border crossing with China.

Outlook For Mongolia In Context

Projected coal production by company in Mongolia. MAK is privately held Mongolyn Alt. Hunnu is now a subsidiary of Banpu (BNPJF.PK). MEC is Mongolia Energy Company (MOAEY.PK). SouthGobi is SouthGobi Resources (SGQRF.PK). Erdenes Tavan Tolgoi is Big TT. MMC is Mongolian Mining Corporation (MOGLF.PK). Source: Trade and Development Bank presentation at Coal Mongolia 2012 by Randolph Koppa.

Rising demand in China. Source: Trade and Development Bank presentation at Coal Mongolia 2012 by Randolph Koppa.

Rising global demand. Source: Trade and Development Bank presentation at Coal Mongolia 2012 by Randolph Koppa.

Conclusion

As several presenters at Coal Mongolia 2012 pointed out, Northeastern Asian countries -- including Korea, Japan and China -- accounted for nearly 40% of the 1 billion ton coal trade in 2011, and India is coming along to join those countries in that demand.

Mongolian Mining Corporation is well positioned to fully profit from marketplace demand and geographically well positioned near China, where the greatest demand is. The company continues to develop washing facilities, ramp up operations, expand export efficiency, seek out strategic acquisitions, and in many ways, find the means to improve profitability.

I have made two trips to Mongolia and plan to return in the fall because Mongolia is supposed to be one of the best performing markets to invest in through at least 2020, and perhaps longer. The information one hears from people locally is different than data you can read in the news media. MCS Group and Mongolian Mining Corporation have positioned themselves well to be at the forefront both of Mongolia's growing economy, and leading examples of well-run Mongolian companies. I expect Mongolian Mining Corporation to produce steady, reasonable and reliable returns to investors over time.

Disclosure: I am long IVN.

Additional disclosure: I will make an initial purchase of Mongolian Mining Corporation shares one week after this article is published with an eye to accumulating shares over time.

Comments

Post a Comment